Church Insurance Packages Tailored to Your Needs

Our church insurance packages are designed to provide comprehensive protection for your house of worship. Whether you are a small congregation renting a space or a large community with multiple buildings and outreach programs, our tailored packages ensure that you receive the coverage you need at a cost that respects your budget.

Hi, I’m Terry Brown, Your Church Insurance Specialist

Since 1981, I have dedicated over four decades to understanding and serving the unique insurance needs of churches across the U.S. My extensive background as a Deacon, Trustee, and International Outreach Director provides me with unparalleled insights into church operations. This experience allows me to offer tailored insurance solutions that are perfectly suited to your ministry’s requirements.

Customized Packages for Different Church Needs

Owner-Occupied Churches

Unique Needs: Owner-occupied churches often require more comprehensive coverage due to the ownership of the property and the variety of activities conducted on-site.

Our Solution: We offer tailored insurance packages that include property, liability, and specialized coverages to protect your entire operation.

Core Liability Coverage:

- Generous Limits: Up to $2,000,000 per occurrence and $5,000,000 in aggregate for robust financial protection.

- Inclusive Insured Definition: Extends coverage to volunteer workers, church members, ministerial staff, and school nurses.

- Coverage for All Church Entities: Automatically includes newly-acquired or formed organizations related to your church.

- Worldwide Protection: Ensures your mission is protected globally.

Additional Liability Coverages:

- Defense Costs: Comprehensive coverage for legal defense costs.

- Specialized Coverages: Includes incidental host liquor liability, medical malpractice, and watercraft liability for non-owned vessels.

- Violent Incident Response: Up to $300,000 coverage for crisis events.

- Legal Expense Reimbursement: Up to $15,000 per occurrence (and $45,000 aggregate).

Tenant Churches

Unique Needs: Tenant churches face distinct challenges, including coverage for leased spaces and protection for church-owned property within those spaces.

Our Solution: Our specialized insurance packages cover the specific needs of tenant churches, ensuring both the leased premises and church-owned assets are protected.

Core Liability Coverage:

- Generous Limits: Up to $2,000,000 per occurrence and $5,000,000 in aggregate for robust financial protection.

- Inclusive Insured Definition: Extends coverage to volunteer workers, church members, ministerial staff, and school nurses.

- Coverage for All Church Entities: Automatically includes newly-acquired or formed organizations related to your church.

- Worldwide Protection: Ensures your mission is protected globally.

Additional Liability Coverages:

- Defense Costs: Comprehensive coverage for legal defense costs.

- Specialized Coverages: Includes incidental host liquor liability, medical malpractice, and watercraft liability for non-owned vessels.

- Violent Incident Response: Up to $300,000 coverage for crisis events.

- Legal Expense Reimbursement: Up to $15,000 per occurrence (and $45,000 aggregate).

Synagogues and Other Ministries

Unique Needs: Ministries, including synagogues, have unique insurance requirements that may differ significantly from traditional church insurance needs.

Our Solution: We provide customized insurance solutions for a variety of ministries, covering everything from liability to property and beyond.

Core Liability Coverage:

- Generous Limits: Up to $2,000,000 per occurrence and $5,000,000 in aggregate for robust financial protection.

- Inclusive Insured Definition: Extends coverage to volunteer workers, church members, ministerial staff, and school nurses.

- Coverage for All Church Entities: Automatically includes newly-acquired or formed organizations related to your church.

- Worldwide Protection: Ensures your mission is protected globally.

Additional Liability Coverages:

- Defense Costs: Comprehensive coverage for legal defense costs.

- Specialized Coverages: Includes incidental host liquor liability, medical malpractice, and watercraft liability for non-owned vessels.

- Violent Incident Response: Up to $300,000 coverage for crisis events.

- Legal Expense Reimbursement: Up to $15,000 per occurrence (and $45,000 aggregate).

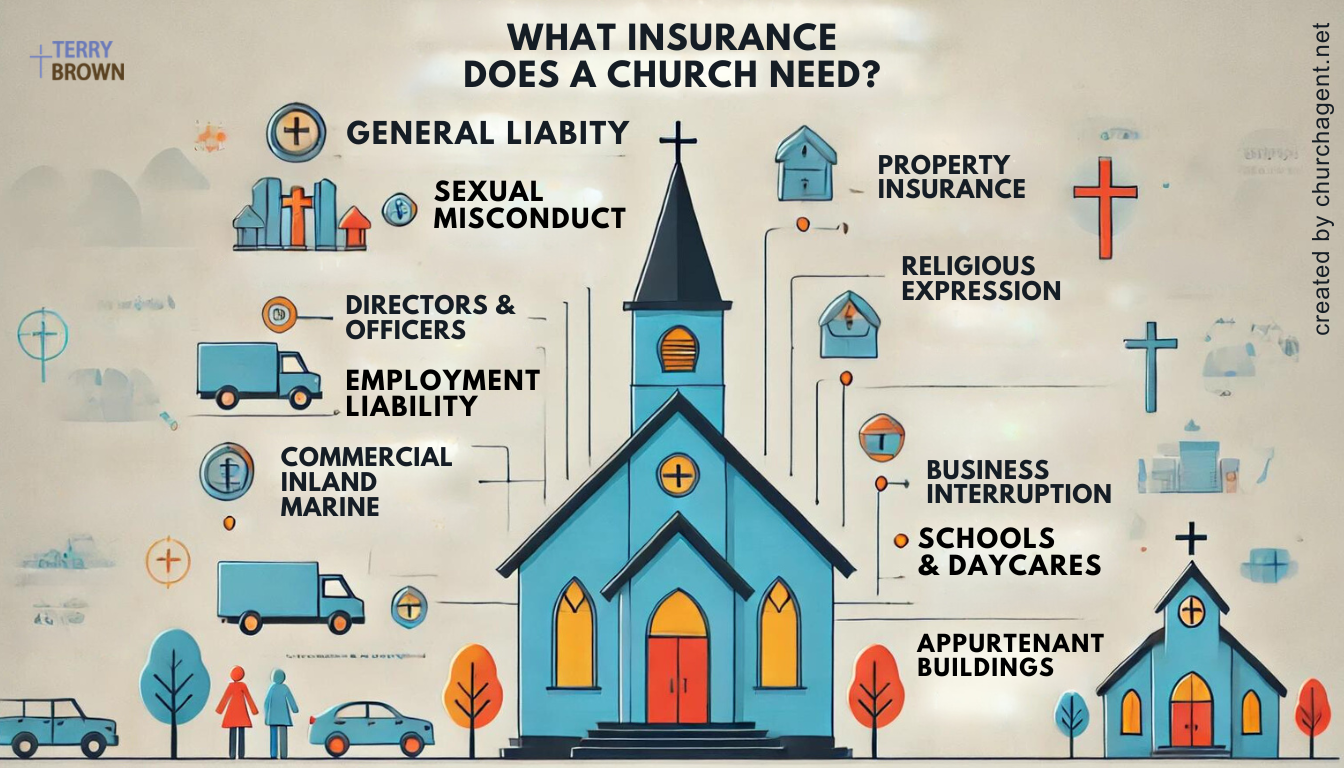

Explore Our Coverage Options

General Liability

What It Is: General liability insurance protects your church against claims of bodily injury and property damage that occur on your premises or as a result of your church’s activities.

Why It’s Important: Accidents can happen during church activities or on church property. This coverage ensures that your church is protected from financial losses due to legal claims.

Learn More About General Liability Insurance

Property Insurance

What It Is: Property insurance covers your church buildings, personal property, and unique items like stained glass windows and outdoor signs.

Why It’s Important: Protecting the physical assets of your church ensures that you can continue your mission without interruption due to property damage or loss.

Learn More About Property Insurance

Appurtenant Buildings

What It Is: This coverage ensures that detached structures such as fellowship halls and storage sheds are covered.

Why It’s Important: Many churches have additional buildings that are integral to their operations. This coverage ensures those buildings are also protected.

Learn More About Appurtenant Buildings Insurance

Business Interruption

What It Is: Business interruption insurance provides financial protection if your church operations are disrupted due to a covered loss.

Why It’s Important: If a disaster strikes, this coverage helps your church recover lost income and continue operations, minimizing the impact on your ministry.

Learn More About Business Interruption Insurance

Commercial Inland Marine

What It Is: Commercial inland marine insurance covers items that are transported over land, protecting your church’s valuable assets during transit.

Why It’s Important: Whether it’s transporting equipment for an event or mission trip, this coverage ensures that your assets are protected while on the move.

Learn More About Commercial Inland Marine Insurance

Directors and Officers Liability

What It Is: This coverage shields your church leaders from personal liability for decisions made in their official capacity.

Why It’s Important: Protecting your church’s leadership ensures that they can make decisions confidently without fear of personal financial loss.

Learn More About Directors and Officers Liability Insurance

Employment Liability

What It Is: Employment liability insurance protects against claims related to wrongful employment practices, ensuring your church’s reputation and finances are secure.

Why It’s Important: This coverage helps safeguard your church from costly legal battles and potential damages related to employment practices.

Learn More About Employment Liability Insurance

Religious Expression

What It Is: This coverage protects your church’s religious activities, safeguarding your right to practice and express your faith.

Why It’s Important: Ensuring that your church can continue its religious practices without legal hindrances is crucial for maintaining your mission and activities.

Learn More About Religious Expression Insurance

Schools & Daycares

What It Is: Specialized coverage for educational facilities associated with your ministry, including protection for legal claims and property damage.

Why It’s Important: Protecting the children and staff in your care is paramount. This coverage ensures that your educational facilities are covered against a range of risks.

Learn More About Schools & Daycares Insurance

Sexual Misconduct Liability

What It Is: This provides vital protection against claims of sexual misconduct, ensuring your church can respond effectively to potential allegations.

Why It’s Important: In the unfortunate event of a sexual misconduct claim, this coverage helps protect your church from financial and reputational damage.

Learn More About Sexual Misconduct Liability Insurance

Ready to Secure Your Church’s Future?

Our comprehensive church insurance packages are designed to meet the unique needs of different types of churches and related organizations. By offering tailored solutions and extensive coverage options, we ensure that your ministry is protected from a wide range of risks, allowing you to focus on your mission with peace of mind.

I partner with a diverse range of insurance carriers, including renowned companies like GuideOne, Liberty Mutual, Church Mutual, and many others. This ensures that I can offer tailored solutions to meet the unique needs of your church.

Licensing Information

I hold a resident insurance license in Georgia (GA RESIDENT LIC), where I’m based. Additionally, I am licensed to provide insurance services in a broad spectrum of states across the country, including AL, CA, CO, DC, FL, GA, ID, IL, IA, IN, KY, LA, MD, MO, MI, MN, MS, NJ, NY, NC, OH, OK, OR, PA, SC, TN, TX, VA, WA, WI, and WV.

Testimonials from Church Leaders:

- “I can say without reservation, most churches have insurance, but are not properly insured. Terry is knowledgeable. Help your church or ministry. Call him to schedule an appointment, let him review what you currently have. You will be glad you did!” – Pastor Charles R Jackson, African Methodist Episcopal Church

- “Terry Brown is like no other insurance agent, he looks out for your best interest and goes above and beyond in service. It’s been a pleasure working with Terry over the years, he makes my job a lot easier.” – Trish Santos, Southeastern District of the C&MA

- “Our church was able to save over $1,000 a year by switching with Terry Brown.” – Chip Nightingale, Corner Bible Church

Get Your Free Church Insurance Quote Today

Use the form below to request a free church insurance quote from Terry Brown

For personalized service and more information, contact Terry Brown at (706) 851-7110 or email terry@churchagent.net.

Yes, I would like a free church insurance quote…

"*" indicates required fields

Frequently Asked Questions

1. What is included in a church insurance package?

A church insurance package from Terry Brown includes comprehensive coverage options designed to protect every aspect of your ministry. This typically includes:

- General Liability Insurance: Covers bodily injury and property damage claims.

- Property Insurance: Protects buildings, personal property, and unique items like stained glass windows and outdoor signs.

- Business Interruption Insurance: Provides financial protection if church operations are disrupted due to a covered loss.

- Directors and Officers Liability Insurance: Shields church leaders from personal liability for decisions made in their official capacity.

- Employment Liability Insurance: Protects against claims related to wrongful employment practices.

- Religious Expression Insurance: Safeguards your church’s religious activities and right to practice faith.

- Sexual Misconduct Liability Insurance: Provides protection against claims of sexual misconduct.

2. Why does my church need property insurance?

Property insurance is essential for protecting your church’s physical assets. It covers:

- Building Damage: Repairs or replaces buildings damaged by covered events.

- Personal Property: Protects contents within the church, including furniture, equipment, and valuable items.

- Unique Church Items: Coverage for items specific to church operations, such as stained glass windows and outdoor signs. This ensures that your church can continue its mission without significant financial loss due to property damage.

3. How does general liability insurance benefit my church?

General liability insurance provides crucial protection by covering:

- Bodily Injury Claims: Legal fees and medical expenses if someone is injured on your property.

- Property Damage Claims: Costs associated with damage to someone else’s property caused by your church’s activities.

- Legal Defense: Coverage for defense costs if a lawsuit arises. This helps safeguard your church’s financial stability and reputation.

4. What is business interruption insurance and why is it important?

Business interruption insurance ensures that your church can recover financially from disruptions. It covers:

- Lost Income: Compensates for lost income during the period of restoration after a covered loss.

- Operating Expenses: Helps cover ongoing expenses like rent, payroll, and utilities during the interruption.

- Extra Expenses: Covers additional costs incurred to continue operations after a loss. This is vital for maintaining your church’s financial health and continuity of operations during unexpected disruptions.

5. Do you offer specialized insurance for tenant churches?

Yes, tenant churches have distinct insurance needs, and our packages are designed to address these. Coverage includes:

- Leased Premises: Protects the space you lease for church activities.

- Church-Owned Property: Covers items owned by the church within the leased space.

- Liability Coverage: Protects against claims related to church activities within the leased premises. Our specialized packages ensure that both the leased property and your church’s assets are adequately protected.

6. What coverage options are available for schools and daycares associated with churches?

Schools and daycares require specialized insurance to cover educational-specific risks. Our coverage includes:

- General Liability: Protection against claims of injury or property damage.

- Professional Liability: Coverage for claims related to educational activities.

- Property Insurance: Protects buildings, equipment, and supplies.

- Abuse and Molestation Coverage: Provides protection against claims of misconduct. This ensures a safe and secure environment for children and staff, protecting against a wide range of potential risks.

7. How can I get a free church insurance quote?

Getting a free quote is simple and straightforward:

- Online Form: Fill out the free quote form on our website, which takes just a few minutes.

- Direct Contact: Call or text Terry Brown at (706) 851-7110 or email terry@churchagent.net. We will promptly follow up to discuss your specific needs and provide a customized insurance quote.

8. What information do I need to provide for a church insurance quote?

To provide an accurate and comprehensive quote, we will need:

- FEIN Number: Verifies your church’s incorporation status and history.

- Loss Runs: Detailed reports from your current or former insurance company listing all claims within the last 5 years. These details help us tailor the coverage to your church’s unique needs and ensure you receive the best possible rates.

9. What sets Terry Brown’s church insurance packages apart from others?

Terry Brown’s church insurance packages stand out due to:

- Extensive Experience: Over four decades of specialized experience in church insurance.

- Deep Understanding: Unique insights into church operations gained from roles as a Deacon, Trustee, and International Outreach Director.

- Customized Solutions: Tailored insurance solutions that address the specific needs of different types of churches and related organizations.

- Trusted Partnerships: Collaboration with leading insurance carriers like GuideOne, Liberty Mutual, and Church Mutual. This combination of expertise, tailored solutions, and dedicated service ensures comprehensive protection for your ministry.

10. What if I don’t have a church in one of your listed states?

Even if your church isn’t located in one of the states where I’m currently licensed, please don’t hesitate to reach out. I am eager to assist with your church’s insurance needs and explore how I can support you, regardless of your location. Contact me directly at (706) 851-7110 or email terry@churchagent.net to discuss your specific situation and find out how we can work together.

About the Author: Terry Brown

Hello, I’m Terry Brown, your dedicated Church Insurance Specialist. Holding a resident insurance license in Georgia, where I’m based, I have the privilege of serving churches across numerous states in the U.S. With over four decades of experience since 1981, I’ve provided tailored insurance solutions to thousands of churches, leveraging my unique background as a Deacon, Trustee, and International Outreach Director to offer insights and services that truly resonate with the specific needs of church operations. My comprehensive licensing allows me to support a vast array of churches, ensuring they receive expert advice and the protection they deserve, regardless of their location.