Understanding church insurance costs is essential for any ministry aiming to protect its assets and operations effectively. As we move through 2024, it’s crucial to stay updated on the factors that influence these costs, ensuring that your church can secure comprehensive coverage without overspending.

In this article, we’ll explore:

- The factors affecting church insurance costs, including size, location, and specific activities

- Detailed cost examples for different types of churches

- Example churches for showing the importance of tailored insurance coverage

By the end of this article, you’ll have a clear understanding of how to estimate the cost to secure the most affordable and effective protection for your church, ensuring peace of mind and financial stability for your ministry.

Key Takeaways

- Tenant church leasing from a school: $900 – $1,200/year

- Church with building and daycare: $2,800 – $4,300/year

- Church with single brick building: $1,900 – $2,600/year

- Large church with multiple locations: $7,000 – $18,000+/year

Financial Considerations for Church Insurance Costs

Church insurance costs vary widely based on several factors:

- Size and Location: Larger churches and those in high-risk areas (e.g., regions prone to natural disasters or high crime rates) typically face higher premiums.

- Value of Property and Contents: Churches with high-value buildings and extensive equipment need higher coverage limits, increasing costs.

- Range of Activities: Offering additional services like daycare or hosting large events can increase liability risks and premiums.

- Claims History: Churches with a history of frequent or severe claims may be considered higher risk, leading to higher premiums.

- Safety Measures: Implementing adequate safety measures (e.g., fire alarms, security systems) can reduce premiums.

By working with a dedicated church insurance agent and regularly reviewing your policy, you can ensure comprehensive protection while managing expenses effectively.

Detailed Cost Examples

Understanding the cost of church insurance can be challenging due to the varying factors that influence premiums. Here are detailed examples of different types of churches and their approximate insurance costs, highlighting the factors that affect these costs.

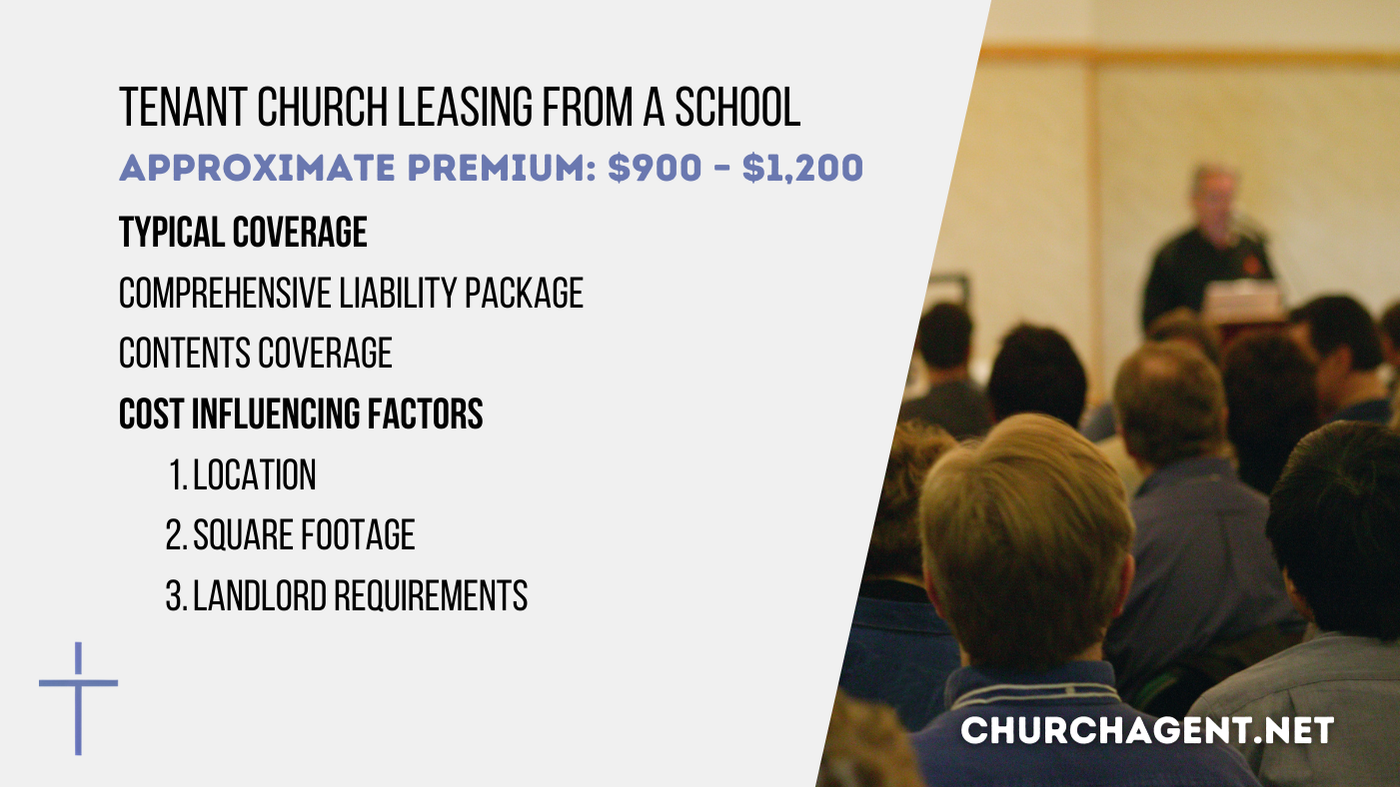

Example 1: Tenant Church Leasing from a School

Approximate Premium: $900 – $1,200

A tenant church is one that leases its building from another church, a school, or a storefront. These churches do not own the building they use, which significantly impacts their insurance needs and costs. Whether the church is new or well-established, it is considered a tenant if it rents its space.

Typical Coverage:

- Comprehensive Liability Package: This always includes coverage for Directors & Officers and sexual misconduct liability.

- Contents Coverage: Minimum coverage for church-owned items within the leased space. If a church has a long term lease and builds out the leased space it is important to protect their investment in the build out.

Cost Influencing Factors:

- Location: Premiums can vary based on the church’s geographic location.

- Square Footage: The size of the leased space and the value of the church’s possessions affect the premium.

- Landlord Requirements: Often, the landlord or building owner will request a certificate of liability naming them as an “additional insured.”

This example assumes a church that does not have to tear down and set up each week. The stability of the church’s use of space and the value of its possessions play significant roles in determining the premium.

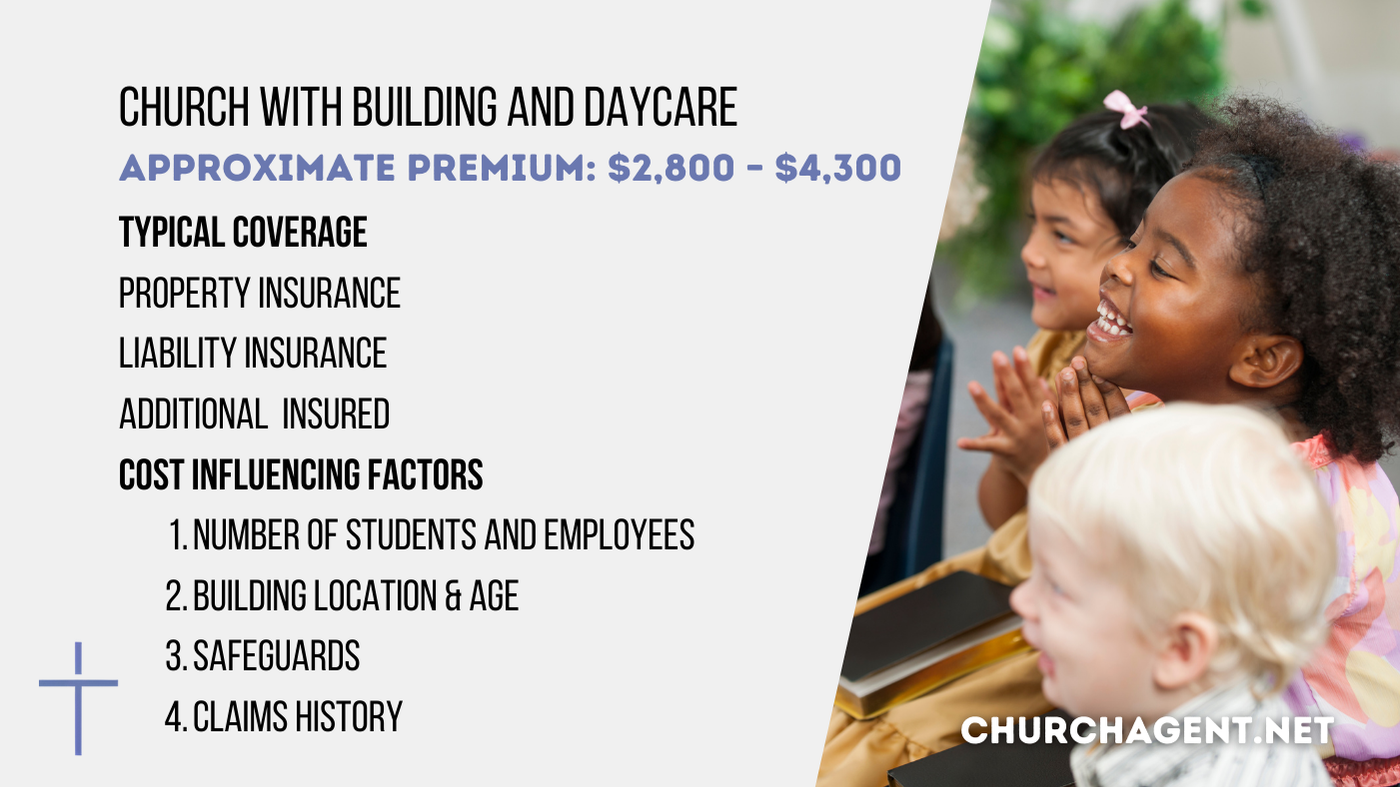

Example 2: Church with Building and Daycare

Approximate Premium: $2,800 – $4,300

This example involves a church that owns its building and operates a small daycare. The building is typically valued around $1,000,000.

Typical Coverage:

- Property Insurance: Covers the church building, its contents, and any daycare equipment.

- Liability Insurance: Includes general liability and additional coverage for daycare operations.

- Additional Insured: The county or Early Learning Coalition might need to be named as an additional insured.

Cost Influencing Factors:

- Number of Students and Employees: More students and staff can increase the risk and, subsequently, the premium.

- Building Location and Age: The location and year of construction impact the insurance cost.

- Safeguards: Built-in sprinklers, monitored burglar and fire alarms, and child protection guidelines can help reduce premiums.

- Claims History: A history of claims can increase the cost of insurance.

Example 3: Church with Single Brick Building

Approximate Premium: $1,900 – $2,600

This example is a church that owns a single brick building valued at around $800,000. This church does not operate a daycare and has minimal furnishings.

Typical Coverage:

- Property Insurance: Covers the building and its contents.

- Liability Insurance: General liability coverage for the church’s operations.

Cost Influencing Factors:

- Year Built: Older buildings might have higher premiums due to the increased risk of structural issues.

- Claims History: A clean claims history can help keep premiums lower.

- Location: Churches in rural areas might have different premiums compared to those in urban settings.

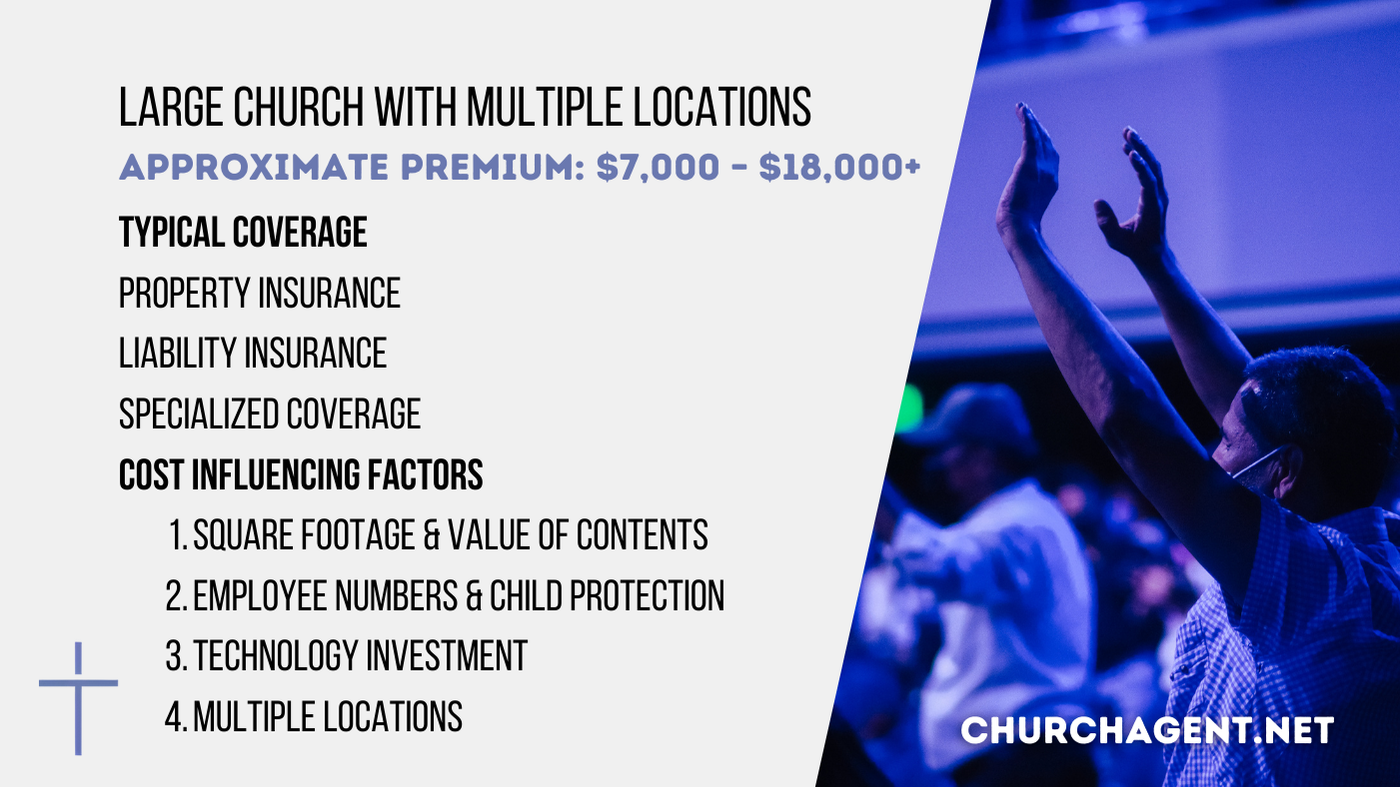

Example 4: Large Church with Multiple Locations

Approximate Premium: $7,000 – $18,000+

This example involves a large church with multiple locations and extensive ministries. This church typically invests heavily in technology and has a large staff.

Typical Coverage:

- Property Insurance: Covers all church buildings and their contents, including technology and equipment.

- Liability Insurance: Extensive liability coverage for multiple locations and various church activities.

- Specialized Coverage: Includes coverage for items being transported between locations, stored in trailers, or used off-site.

Cost Influencing Factors:

- Square Footage and Value of Contents: Larger buildings and more valuable contents increase premiums.

- Employee Numbers and Child Protection: More employees and the need for stringent child protection guidelines can raise insurance costs.

- Technology Investment: High-value technology requires additional coverage, impacting premiums.

- Multiple Locations: Each location needs to be insured, increasing the overall premium.

Factors Influencing Costs in Each Example

Across all examples, several common factors influence church insurance costs:

- Building Value and Contents: Higher value buildings and contents require higher coverage limits.

- Location: Geographic risks such as natural disasters or high crime rates impact premiums.

- Activities and Services: Offering additional services like daycare or mission trips requires extra coverage.

- Safeguards and Claims History: Implementing safety measures and having a clean claims history can help lower premiums.

Tailored insurance solutions ensure that each church receives the coverage necessary to protect against potential risks, providing peace of mind and financial security.

Which Church Are You?

Tailored church insurance can protect your ministry and potentially save costs. Here are some practical scenarios showcasing how comprehensive insurance coverage benefits various types of churches.

Scenario 1: Protecting a Small Church with Limited Resources

A small rural church with a limited budget secured comprehensive insurance by bundling property and liability coverage and implementing safety measures like fire alarms and regular safety drills. These actions significantly reduced premiums, allowing the church to allocate more funds to its community outreach programs while ensuring its property and congregation were well-protected.

- Actions Taken:

- Bundled property and liability insurance

- Installed fire alarms and conducted safety drills

- Benefits:

- Significant premium reduction

- Increased funding for community outreach

Scenario 2: Comprehensive Coverage for a Growing Urban Church

A mid-sized urban church expanding its facilities and programs, including a new daycare center and youth outreach activities, conducted a thorough risk assessment. The tailored coverage included property insurance for new buildings, liability coverage for the daycare, and professional liability for counseling services. Implementing risk management practices, such as background checks for daycare staff and enhanced security systems, allowed the church to confidently expand its activities with robust protection against potential risks.

- Actions Taken:

- Conducted a thorough risk assessment

- Secured property insurance for new buildings

- Added liability coverage for daycare and counseling services

- Implemented background checks and enhanced security systems

- Benefits:

- Comprehensive protection for new and existing programs

- Confidence to expand activities

Scenario 3: Ensuring Protection for a Large, Multi-Location Church

A large church with multiple campuses and diverse activities, including mission trips and international outreach, required a comprehensive insurance plan. By creating a policy that included property insurance for all locations, liability coverage for various activities, and specialized policies for mission trips and international travel, the church secured extensive coverage at a competitive rate. This allowed the church to continue its expansive mission work without worrying about financial vulnerabilities.

- Actions Taken:

- Property insurance for multiple locations

- Liability coverage for diverse activities

- Specialized policies for mission trips and international travel

- Benefits:

- Extensive coverage at a competitive rate

- Financial stability for expansive mission work

Scenario 4: Effective Claims Management and Continuous Protection

When a church experienced a significant loss due to a fire, its comprehensive property insurance, which included ordinance or law coverage, allowed it to rebuild to current codes without incurring additional costs. The smooth claims process ensured quick recovery. Additionally, the church used this opportunity to review and update its policy, adding coverage for newly acquired property and enhancing risk management practices to prevent future incidents.

- Actions Taken:

- Comprehensive property insurance with ordinance or law coverage

- Efficient claims process for quick recovery

- Policy review and updates after the incident

- Enhanced risk management practices

- Benefits:

- Quick recovery and rebuilding to current codes

- Improved future risk management

Scenario 5: Achieving Savings Through Policy Reviews and Updates

An established church conducted a regular review of its insurance policy and identified several areas for savings. Removing coverage for outdated equipment and adjusting coverage limits to reflect current property values resulted in substantial savings. Implementing new safety protocols qualified the church for additional discounts. These changes allowed the church to invest more in its community programs while maintaining optimal coverage.

- Actions Taken:

- Regular policy reviews identified savings

- Removed outdated equipment coverage

- Adjusted coverage limits to current property values

- Implemented new safety protocols for additional discounts

- Benefits:

- Significant cost savings

- Reinvestment in community programs

Tailored church insurance is vital for protecting your ministry from various risks and ensuring the continuity of your operations. By partnering with me, Terry Brown, you benefit from my extensive expertise, personalized solutions, and commitment to finding cost-effective coverage.

Contact me for a comprehensive insurance review and discover how my specialized church insurance solutions can benefit your ministry.

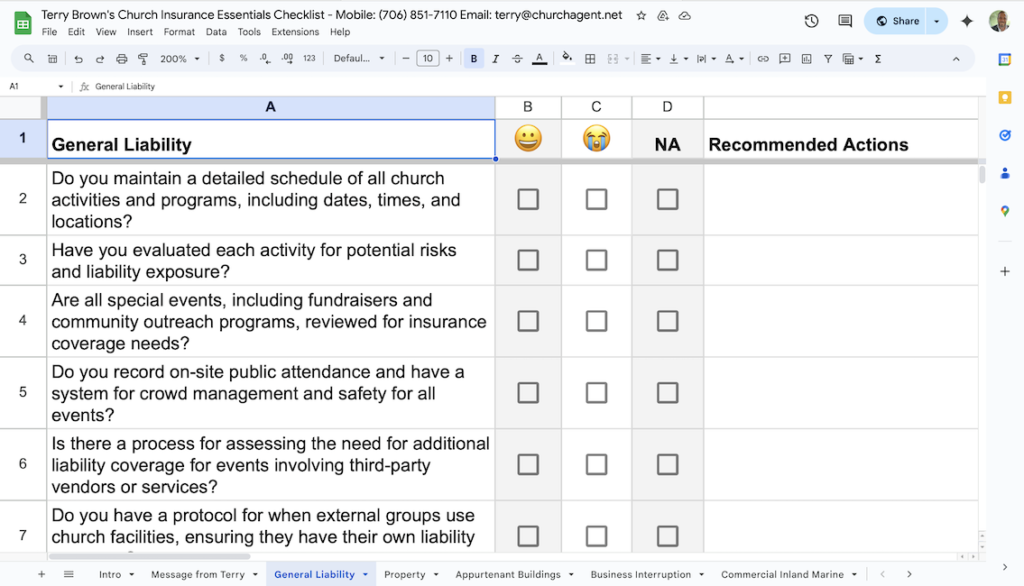

Free Resource: Church Insurance Essentials Checklist

Understanding the cost of church insurance is just the first step. To ensure you get the best coverage tailored to your specific needs, I’ve created a “Church Insurance Essentials Checklist.” This tool will help you identify key areas to focus on, potentially saving you money and ensuring comprehensive protection:

How to Use the Checklist:

- Make Your Own Copy:

- Click the link above and open the File Menu at the top left of the screen. Select ‘Make a copy’ to create a personal version in your Google Drive.

- Name Your Copy:

- You can name it anything that helps you identify it easily, perhaps including your church’s name.

- Save and Customize:

- Choose where to save it in your Google Drive and start customizing it to suit your church’s needs. This will enable you to use the checklist interactively and keep track of your progress.

By using this checklist, you can ensure that you’ve covered all necessary aspects of church insurance, helping you make informed decisions and potentially reducing your premiums. Feel free to reach out if you have any questions about using the checklist!

Frequently Asked Questions

What factors increase church insurance costs?

Several factors can increase church insurance costs, including the size and location of the church, the value of the property and its contents, the range of activities conducted, and the church’s claims history. Churches in areas prone to natural disasters or with higher crime rates typically face higher premiums. Additionally, churches with extensive programs, such as daycare or mission trips, may need additional coverage, increasing overall costs.

Can churches get discounts on insurance?

Yes, churches can qualify for various discounts on insurance. Implementing safety measures, such as fire alarms and security systems, can reduce premiums. Bundling multiple policies, such as property and liability insurance, can also lead to discounts. Additionally, some insurers offer discounts for churches that conduct regular risk assessments and maintain a good claims history.

How often should churches review their insurance policies?

Churches should review their insurance policies annually or whenever there are significant changes in their operations or property. Regular reviews help ensure that the coverage remains adequate and up-to-date, reflecting any new assets, activities, or regulatory requirements. Periodic reviews also provide an opportunity to identify potential savings and eliminate unnecessary coverage.

What specific coverages should a church consider?

Churches should consider a range of coverages to protect against various risks:

- Property Insurance: Covers the church building, furnishings, equipment, and valuable items like stained glass windows.

- General Liability Insurance: Protects against claims of bodily injury or property damage occurring on church premises or during church activities.

- Professional Liability Insurance: Covers claims of negligence or misconduct by church leaders and staff, particularly important for counseling services.

- Workers’ Compensation: Provides benefits for employees injured while working, including medical expenses and lost wages.

- Specialized Coverages: Includes policies like cyber liability, sexual misconduct liability, and insurance for mission trips and international travel.

How can a church ensure it has the right coverage?

To ensure comprehensive and appropriate coverage:

- Work with a Specialized Agent: A dedicated church insurance agent understands the unique risks and needs of religious organizations and can tailor coverage accordingly.

- Conduct Regular Risk Assessments: Regularly evaluate potential risks and adjust coverage to address new or evolving threats.

- Implement Risk Management Practices: Proactive risk management can reduce the likelihood of claims and help secure lower premiums.

- Keep Detailed Records: Maintain accurate records of property, equipment, and activities to ensure all assets and operations are adequately covered.

Is it possible to reduce premiums without sacrificing coverage?

Yes, there are strategies to reduce premiums while maintaining adequate coverage:

- Increase Deductibles: Opting for a higher deductible can lower premium costs, though it’s important to ensure the church can cover the deductible if a claim arises.

- Safety Improvements: Investing in safety measures, such as installing fire and security systems, can lead to discounts and lower premiums.

- Eliminate Redundant Coverage: Regular policy reviews can identify and eliminate unnecessary or redundant coverage, reducing costs.

- Leverage Group Programs: Participating in group insurance programs through denominational bodies or church associations can provide access to lower rates.

How can a church prepare for an insurance claim?

Being prepared for an insurance claim involves several steps:

- Document Everything: Keep detailed records of all property, equipment, and activities. Photographs and inventories can be invaluable in the event of a claim.

- Know Your Policy: Understand the specifics of your insurance policy, including coverage limits, deductibles, and the claims process.

- Train Staff and Volunteers: Ensure that those responsible for managing the church’s operations know how to handle and report an incident.

- Prompt Reporting: Report incidents to your insurance agent promptly to ensure timely processing of claims.

What should a church do if it experiences a loss?

If your church experiences a loss:

- Ensure Safety First: Make sure everyone is safe and take steps to prevent further damage.

- Document the Damage: Take photographs and make detailed notes of the damage.

- Contact Your Agent: Notify your insurance agent as soon as possible to start the claims process.

- Follow Up: Keep in touch with your agent and provide any additional information or documentation needed to process the claim efficiently.